Why Are Crypto Firms Stepping Into Trade Finance?

- bilal486

- Oct 1, 2025

- 3 min read

Updated: Nov 13, 2025

Introduction

With paper-based trade finance systems struggling to keep pace with modern commerce, crypto-native solutions are rapidly moving from the margins to the mainstream.

Trade Finance Fails to Meet Modern Demand

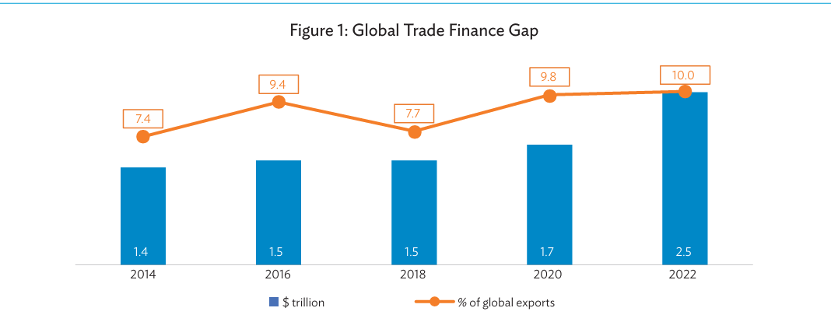

The global trade finance gap grew to $2.5 trillion in 2022, up from $1.7 trillion in 2020. SMEs, particularly in emerging markets, bear the brunt—often rejected or excluded due to outdated systems. Paper-heavy, risk-averse processes can’t keep up with shrinking transaction sizes and fast-evolving supply chains. Crypto firms are stepping in, not to replace trade finance, but to redesign it for a digital-first world.

Sources: ADB. 2023 Trade Finance Gaps, Growth, and Jobs Survey—Banks; and World Trade Organization. WTO Data

Rebuilding Infrastructure from the Ground Up

Blockchain enables real-time, shared access to trade data, replacing manual documentation and intermediaries. Projects like we.trade and Marco Polo, built on frameworks like Hyperledger and R3 Corda, show how settlement times and compliance costs can be reduced by over 50%. From IBM-Maersk logistics to blockchain-based exports, crypto infrastructure is already live.

Stablecoins Are Becoming the New Settlement Layer

Stablecoins such as USDT allow instant, borderless payments without SWIFT or FX friction. For businesses in volatile or underbanked markets, this offers faster liquidity and lowers transaction barriers. Settlements that once took days now happen in minutes.

Crypto Networks Free Up Global Liquidity

Platforms like Ripple remove the need for pre-funded accounts by using assets like XRP for instant settlement. This gives corporates better control over working capital—especially useful in fragmented or emerging markets with limited clearing infrastructure.

Agriculture Goes Digital: The AgriDex Example

One of the most compelling cases for crypto-enabled trade finance can be found in the agricultural sector. Platforms like AgriDex, built on the Solana blockchain, are tokenizing physical commodities such as wheat, corn, and coffee. This process enables producers to convert their goods into on-chain assets that can be settled instantly, with transaction fees below 0.5%. More importantly, these digital tokens can be used as collateral to unlock financing—without waiting for warehouse receipts or buyer confirmations. This model directly addresses many of the pain points in agricultural trade, from delayed payments to fragmented logistics. Backed by early-stage funding and aiming to digitize a $2.7 trillion market, AgriDex represents a broader shift toward asset tokenization in commodity finance.

SMEs Gain Direct Access to Capital via Crypto

Perhaps the most transformative aspect of crypto-led innovation in trade finance is its potential to close the persistent SME funding gap. Globally, SMEs represent over 90% of businesses, yet more than 40% cannot obtain the credit they need. In emerging markets, this translates into a multi-trillion-dollar shortfall. Crypto-based platforms are changing the rules of engagement by evaluating creditworthiness through transaction history and blockchain data rather than traditional credit scores. In Mexico, Verqor offers input financing based on trader activity, achieving exceptionally low default rates. Meanwhile, Apollo Agriculture in Kenya and Zambia supports hundreds of thousands of farmers through mobile-based loans. These decentralized models remove layers of bureaucracy and bring capital directly to where it’s needed most.

Smart Contracts Are Automating Execution

Smart contracts are digitizing the core functions of trade execution—automating tasks like payment release, delivery verification, and penalty enforcement. In platforms like Ripple and AgriDex, these contracts reduce reliance on letters of credit and significantly cut administrative friction, transforming how global transactions are carried out.

Crypto Tools Are Quietly Reshaping Global Trade

Crypto firms are not trying to rebuild trade finance from scratch, but to upgrade it. Through modular, interoperable technologies, they are solving longstanding inefficiencies and expanding access. With blockchain infrastructure maturing and stablecoin use normalizing, the convergence of decentralized finance and global trade is no longer a theoretical future. It is already reshaping how businesses move goods, capital, and trust across borders.

Comments